Congratulations on buying your first home! Now, let's tackle property taxes. Understanding your home's taxable value is crucial for managing your finances. This guide will walk you through the process, step-by-step, in plain English.

Understanding Taxable Value vs. Market Value

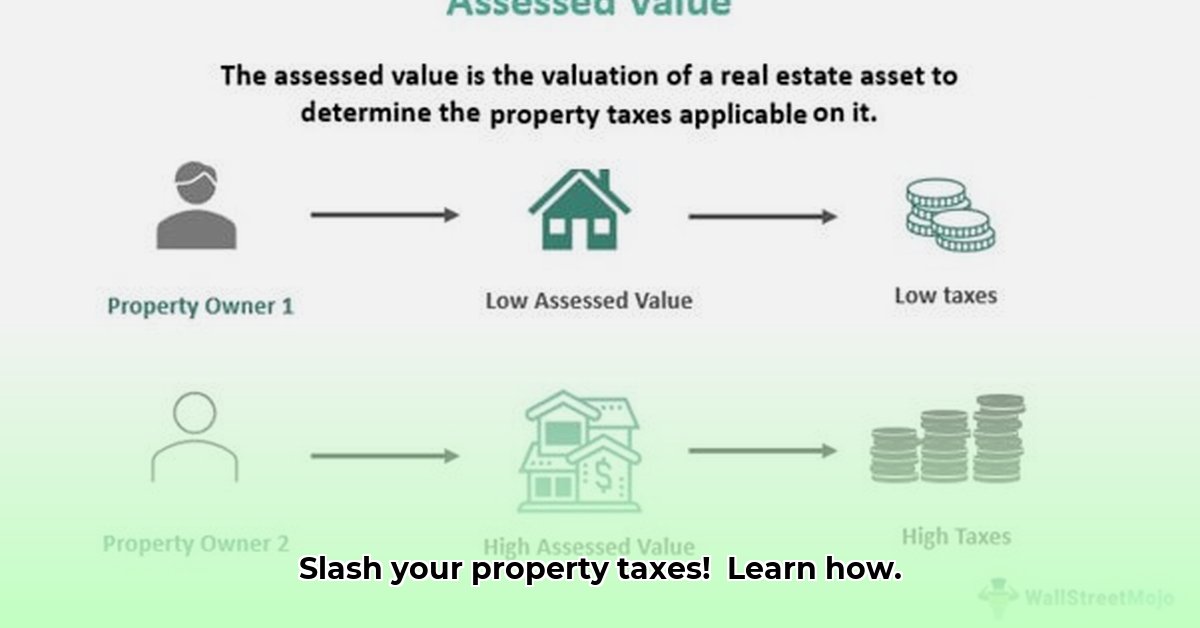

Before we begin, it's important to understand the difference between your home's taxable value and its market value. Market value is simply what your house would sell for today, based on comparable properties in your neighborhood. Taxable value, however, is the value your local government uses to calculate your property taxes. It's typically lower than the market value. The exact calculation varies by location, but it aims to create a fair assessment for all properties within a community. This ensures that you pay a reasonable tax rate relative to others within the area.

Finding Your Home's Taxable Value: Two Easy Methods

You have two primary ways to find your home's taxable value:

Your Property Tax Statement: This official document, usually mailed annually, clearly states your home's assessed (taxable) value. It's the most straightforward way to determine this crucial figure.

Your Local Assessor's Office: Each county has an assessor's office responsible for evaluating property values. Many offer online search tools where you can input your address to find your property's details, including its taxable value. If you cannot find the information online, calling them directly is always an option. They are experts in this and are usually happy to help. Did you know that contacting the assessor's office directly often results in a faster resolution?

A Step-by-Step Guide to Finding Your Taxable Value

Let's find that number!

Locate Your County Assessor's Office: Use a search engine (Google, Bing, etc.) to find the assessor's office for your county.

Explore Their Website: Most assessor websites are user-friendly. Look for sections like "property search," "assessment lookup," or "tax records." You'll need your property address.

Search for Your Property: Enter your exact address and verify its accuracy. The website should display your property's information, including the taxable value.

Check Your Tax Statement (If Needed): If you're having trouble online, check your property tax statement. The taxable value is prominently displayed in it.

Contact the Assessor's Office (If Necessary): If you still can't find it, call your assessor's office for assistance. They are equipped to guide you through the process. Don't hesitate to contact them for help!

What If You Think Your Taxable Value Is Wrong?

Property tax assessments can sometimes be inaccurate. If you believe your home's assessed value is significantly off, you usually have the right to appeal. Check your local regulations for the process. Gather supporting evidence, like recent appraisals or comparable sales in your area. Remember, timely action is essential in these situations, so consult your local laws for deadlines.

Key Differences: Taxable Value vs. Market Value

| Feature | Taxable Value | Market Value |

|---|---|---|

| Purpose | Property tax calculation | Potential sale price |

| Source | Local assessor's office | Multiple factors, including comparable sales |

| Frequency | Periodic reassessment (frequency varies) | Constantly fluctuating |

Knowing your home's taxable value is crucial for responsible property tax management. By following these steps, you can confidently determine your home's assessed value and proactively manage your property taxes. Don't hesitate to seek assistance where necessary – you are not alone.

Appealing a Property Tax Assessment (Optional Section)

Key Takeaways for Appealing:

- A fair assessment ensures you pay your correct portion of taxes.

- Discrepancies justify an appeal.

- Strong evidence is crucial for a successful appeal.

- Knowing the appeal process, deadlines, and your options is key.

If you believe your home's assessed value is too high, you can appeal. First, thoroughly review your home's current assessed valuation (found on your tax bill). Then, gather strong supporting evidence, such as recent comparable sales, a professional appraisal, and documentation for any home improvements or repairs. Next, carefully review your local appeals process—deadlines are important! Prepare a well-documented appeal outlining your reasons for disagreement. For complex situations, a property tax consultant or attorney can significantly improve your chances of success. Remember, you have the right to ensure a fair tax assessment.